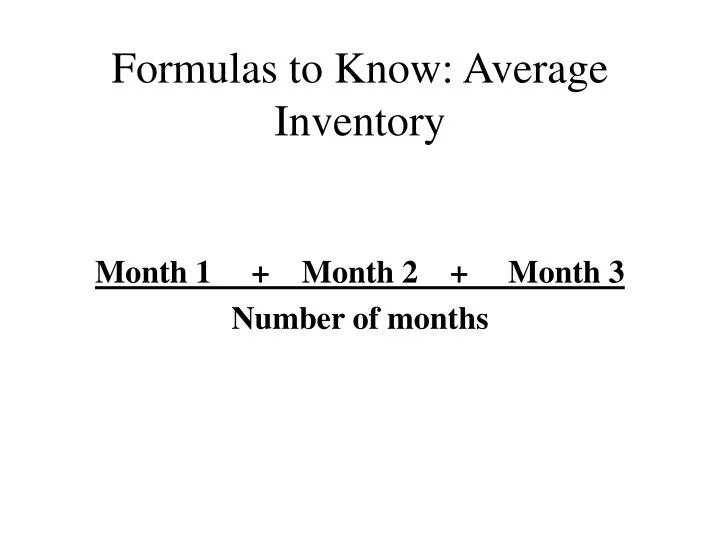

Prepare a schedule to compute the June 30, 2017, inventory at the June 30 price level under the dollarvalue LIFO retail method. The general price level has increased from 100 at January 1, 2017, to 108 at June 30, 2017. As the name suggests, it is calculated by arriving an average of stock at the beginning and end of the period. (b) Without prejudice to your solution to part (a), assume that you computed the June 30, 2017, inventory to be $59,400 at retail and the ratio of cost to retail to be 70%. Average inventory is an estimated amount of inventory that a business has on hand over a longer period. Cost Selling Price Inventory, January 1 $ 30,000 $ 43,000 Markdowns 10,500 Markups 9,200 Markdown cancellations 6,500 Markup cancellations 3,200 Purchases 104,800 155,000 Sales revenue 154,000 Purchase returns 2,800 4,000 Sales returns and allowances 8,000 Instructions (a) Prepare a schedule to compute Aristotle’s June 30, 2017, inventory under the conventional retail method of accounting for inventories.

That's why retailers need to have another metric in their hands to understand predictive sales and how much inventory they need. This method calculates a store's total inventory value by taking the total retail value of the. However, inventory management can be a hassle that negatively impacts numbers. Retail Inventory Method: An accounting procedure for estimating the value of a store's merchandise. To prepare the store’s financial statements at June 30, 2017, you obtain the following data. 08 June 2021 Every retailer is curious about what they sell or how much money they make in a given time. adopted the retail method of accounting for its merchandise inventory.

0 kommentar(er)

0 kommentar(er)